by Cydney Posner

In light of our proximity to election day — finally — it seemed like a good time to take a look at the CPA-Zicklin Index of Political Disclosure and Accountability, just released for 2016, which annually evaluates corporate practices and disclosure regarding political spending. In a record-breaking year for outside spending in U.S. elections, the Index concluded that, for companies in the S&P 500, political spending disclosure is becoming a common practice: “Indisputably, a voluntary trend toward greater sunlight, board oversight and restrictions on political spending continues.”

The Index, which is produced by the Center for Political Accountability in conjunction with the Zicklin Center for Business Ethics Research at The Wharton School at the University of Pennsylvania, compared the transparency policies and practices of almost the entire S&P 500 across consecutive years. The Index identified 35 companies in the S&P 500 that received top-five rankings for political disclosure and accountability, reflecting a 52% increase from 23 high scorers identified in 2015. For the 462 companies in the S&P 500 that were analyzed in both 2015 and 2016, the overall average score increased from 39.7% to 43.3% with increases in each of the key categories of disclosure, compliance and oversight: “average overall scores for disclosure rose to 36.73 percent from 33.97; for policy rose to 60.66 percent from 58.73 percent; and for oversight rose to 37.00 percent from 34.85 percent. The number of companies with disclosure and accountability policies that ranked in the first or second tier stood at 181, or more than one-third of the S&P 500. Last year, the number was 171 companies.” The Index indicates that there is “a strong positive correlation between the size of a company and the detail and breadth of its political disclosure and accountability policies.” In addition, the top-ranked industrial sectors for political disclosure and accountability were utilities, health care, consumer staples, telecommunications services and materials.

Not surprisingly, shareholder engagement, particularly where an agreement was reached with the shareholders, had a positive impact on company scores, leading to “notably better disclosure and accountability policies.” For companies that engaged and reached agreement with shareholders, the average overall score was 71.8%, compared to 48.8% for companies that engaged with shareholders but did not reach agreement and 26.7% for companies that did not engage at all.

SideBar: Although the SEC received over a million comment letters on a 2011 rule-making petition submitted by a group of academics requesting that the SEC propose rules requiring disclosure of the use of corporate resources for political activities, as discussed in this PubCo post, Chair White has been firmly against any such undertaking, contending that the SEC should not get involved in politics. (But isn’t not acting also political?) According to CNBC, on Friday, in a move that may be more “working the refs” for the next administration than expecting action in the remaining months of the current one, Senator Elizabeth Warren sent a letter to President Barack Obama, calling on him to replace Mary Jo White as SEC Chair because of White’s refusal to develop a political spending disclosure rule. Warren’s letter argued that “Chair White’s refusal to move forward on a political spending disclosure rule serves the narrow interests of powerful executives who would prefer to hide their expenditures of company money to advance their own personal ideologies.” White has also faced criticism from two former SEC Chairs and one former Commissioner, who politely berated (well, maybe not so politely) her failure to take action on the 2011 rulemaking petition to require political spending disclosure.(See this PubCo post.) And last year Senate Dems sent a letter to White adding their voices “to the many who have expressed frustration and disappointment that the SEC decided to remove this issue from its regulatory agenda entirely.” (See this PuCo post.)

As discussed in this PubCo post, this PubCo post and this PubCo post, Congressional Republicans have long sought to prevent the use of SEC appropriations for adopting requirements for political spending disclosure. (Not that the SEC was addressing the issue anyway.) More specifically, the 2015 version of the prohibition was limited to “finalizing” a rule, which many thought would have allowed the SEC to perform work in preparation for adoption. That provision stated that “[n]one of the funds made available by any division of this Act shall be used by the Securities and Exchange Commission to finalize, issue, or implement any rule, regulation, or order regarding the disclosure of political contributions, contributions to tax exempt organizations, or dues paid to trade associations.” The version that was offered in 2016 expanded the scope to provide that “[n]one of the funds made available by this Act shall be used by the Securities and Exchange Commission to study, develop, propose, finalize, issue, or implement any rule, regulation, or order regarding the disclosure of political contributions to tax exempt organizations, or dues paid to trade associations.” In her letter, Warren asserted that “Congressional Democrats will fight to remove the recently passed rider from December’s government funding legislation,” and she urged the President to threaten to veto the bill. However, she added, “these efforts will be meaningless as long as Chair White continues to control the agenda of the SEC.”

More specifically, the Index showed the following:

Publicly available policies and other information

- Almost 90% of the companies included in the 2016 Index, “had at least some level of policy posted on their websites.” In 2016, for 56% of companies (compared to 52% in 2015), the policies were “comprehensive and robust,” providing “a detailed policy of giving posted on their websites.” For 33% (compared to 35% in 2015), the policies were “brief, somewhat vague policies.”

- In 2016, 41% of companies (compared to 38% in 2015) “fully described” the political entities to which they will or will not donate, while 21% (compared to 22% in 2015) provided “some level of information” about the recipients of their political donations.

- In 2016, 30% of companies (compared to 28% in 2015) provided “detailed information” on the public policy priorities that inform their political spending, while 10% (compared to 12% in 2015) provided “vague language” about their priorities.

- With regard to trade associations, 45% of companies (compared to 41% in 2015) disclosed “some level” of payments to trade associations or directed trade associations not to use their payments for election-related purposes.

- With regard to 501(c)(4) “social welfare” organizations (where donors may remain confidential), 31% (compared to 25% in 2015) disclosed “some level” of information about their donations, had policies prohibiting contributions to these groups or instructed 501(c)(4)s not to use their contributions for election-related activity.

- In 2016, 281 companies (compared to 270 in 2015) dedicated a webpage or similar space to political spending and related disclosure.

Restrictions on Political Spending

- The Index showed that there has been a major shift over time in the number of companies that imposed some type of restriction on their political spending, including strengthening policies on “dark money,” such as contributions to 501(c)(4) social welfare organizations.In 2016, 29% of companies (compared with 25% in 2015) placed “some level” of restriction on their political spending.

- Eight companies reported that they did not use funds from their corporate treasuries to influence elections and also requested that trade associations not use their payments for political purposes.

- Fifteen companies allowed political expenditures only through employee-funded Political Action Committees (PACs), while 23 companies did not have PACs and made few or no political donations.

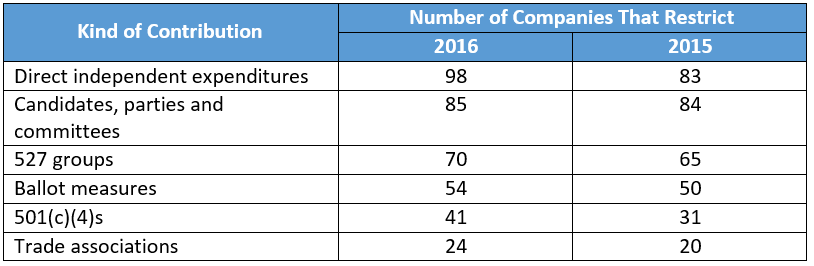

- As depicted in the table below (from the Index), some companies implemented restrictions based on contribution type:

Board Oversight

- Last year, CPA members developed a framework for board oversight of political spending designed to help boards make informed decisions that are consistent with company strategies, policies and values and that mitigate risks to the extent possible. The framework involves three elements: 1) deciding whether the company should engage in political spending; 2) deciding whether to disclose that spending; and 3) ensuring that appropriate oversight and other policies and procedures are in place.

- In 2016, 47% of companies (compared to 43% in 2015) reported regular board oversight of corporate political spending, including through board committees: 34% of companies (compared to 30% in 2015) reported board committee review of company policy on political spending; 38% (compared to 34% in 2015) reported board committee review of company political expenditures; and 30% (compared to 24% in 2015) reported board committee review of company payments to trade associations.

You must be logged in to post a comment.